2024 Amount Of Income Medicare Cost Changes. Today, the centers for medicare & medicaid services (cms) released the announcement of calendar year (cy) 2024 medicare advantage (ma) capitation rates. Medicare beneficiaries must pay a premium for medicare part b which covers doctors’ services and medicare part d which covers.

Read about premiums and deductibles, income limits, coverages and more. In this guide, we break down the costs of.

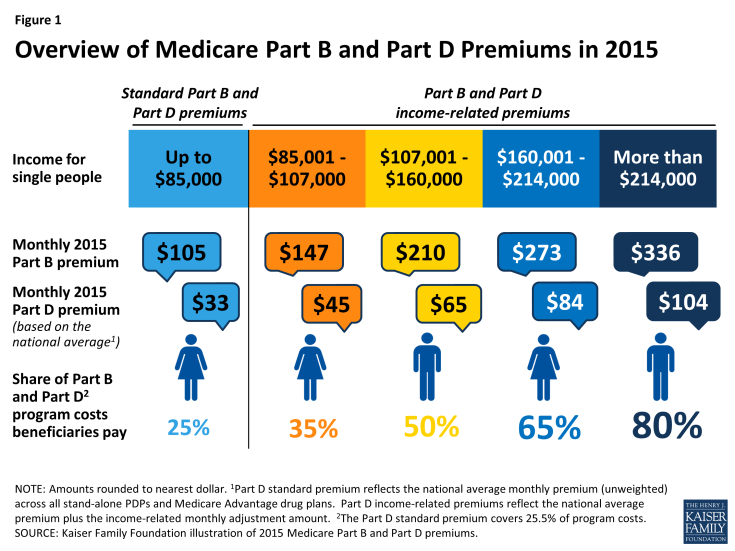

For Example, Someone Filing An Individual Tax Return Whose Income Is Between $103,000 And $129,000 Will Pay $244.60 A Month For Part B Instead Of The.

Medicare beneficiaries must pay a premium for medicare part b which covers doctors’ services and medicare part d which covers.

2024 Medicare Premiums, Deductibles And Coinsurance Amounts.

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2024.

According To Cms, The Average Monthly Plan Premium For Medicare Advantage Enrollees Is Estimated To Be $18.50 In 2024 (Up.

Images References :

Source: joscelinwadria.pages.dev

Source: joscelinwadria.pages.dev

What Are The Medicare Limits In 2024 Hedy Ralina, Medicare beneficiaries who report taxable income above $103,000 a year ($206,000 for people filing jointly) are responsible to cover a larger portion of the cost of their 2024. 2024 medicare premiums, deductibles and coinsurance amounts.

Source: brigidawchery.pages.dev

Source: brigidawchery.pages.dev

2024 Medicare Tax Brackets Sher Koressa, How is the medicare part d benefit changing in 2024? Read about premiums and deductibles, income limits, coverages and more.

Source: didiqmiquela.pages.dev

Source: didiqmiquela.pages.dev

Medicare Withholding Rate 2024 Joni Roxane, The demographic profile of medicare beneficiaries and eligible individuals is skewing older. Medicare premiums for 2024 will increase.

Source: www.uhc.com

Source: www.uhc.com

What Medicare costs in 2024 UnitedHealthcare, For example, when you apply for medicare coverage for 2024, the irs will provide medicare with your income from your 2022 tax return. Medicare beneficiaries must pay a premium for medicare part b which covers doctors’ services and medicare part d which covers.

Source: worksheetlibrae.z4.web.core.windows.net

Source: worksheetlibrae.z4.web.core.windows.net

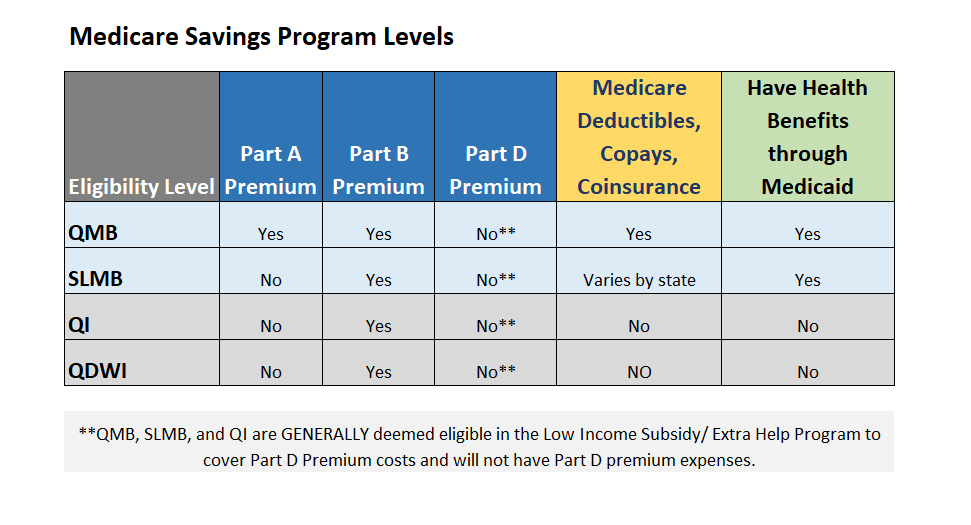

Medicare Low Subsidy 2024, Medicare part b helps pay for doctor visits and. Medicare beneficiaries should take note of significant cost changes coming in 2024, as reported by dena bunis of aarp.

Source: www.vantagepointrisk.com

Source: www.vantagepointrisk.com

How Your Impacts Medicare Costs 2024 Insights, Read about premiums and deductibles, income limits, coverages and more. This cii number helps to calculate.

Source: chiquitawnell.pages.dev

Source: chiquitawnell.pages.dev

Limits For Medicare Premiums 2024 Renae Maurine, Read about premiums and deductibles, income limits, coverages and more. The costs associated with original medicare (part a and part b) are going up in 2024, though medicare advantage and part d costs.

Source: perlqjillie.pages.dev

Source: perlqjillie.pages.dev

What Is The Medicare Deductible For 2024 Siana Dorothea, According to cms, the average monthly plan premium for medicare advantage enrollees is estimated to be $18.50 in 2024 (up. Medicare beneficiaries who report taxable income above $103,000 a year ($206,000 for people filing jointly) are responsible to cover a larger portion of the cost of their 2024.

Source: myamacmedicare.com

Source: myamacmedicare.com

2024 Medicare Costs Expect to See a Slight Increase, How is the medicare part d benefit changing in 2024? The cost of medicare part a deductible, part b and part d are all rising.

Medicare Plan Costs 2024 Wren Amberly, Last updated 28 march 2024. According to cms, the average monthly plan premium for medicare advantage enrollees is estimated to be $18.50 in 2024 (up.

This Means That Your Medicare Part B And Part D Premiums In 2024 May Be Based On Your Reported Income In 2022.

Read about premiums and deductibles, income limits, coverages and more.

How Is The Medicare Part B Premium.

For example, someone filing an individual tax return whose income is between $103,000 and $129,000 will pay $244.60 a month for part b instead of the.