Federal Employer Withholding Tax Table 2024. See current federal tax brackets and rates based on your income and filing status. The federal income tax has seven tax rates in.

The current rate for medicare is 1.45% for the. Instructions for using the irs’s tax withholding estimator when figuring withholding for multiple jobs, which were removed in the 2023 version, have been added.

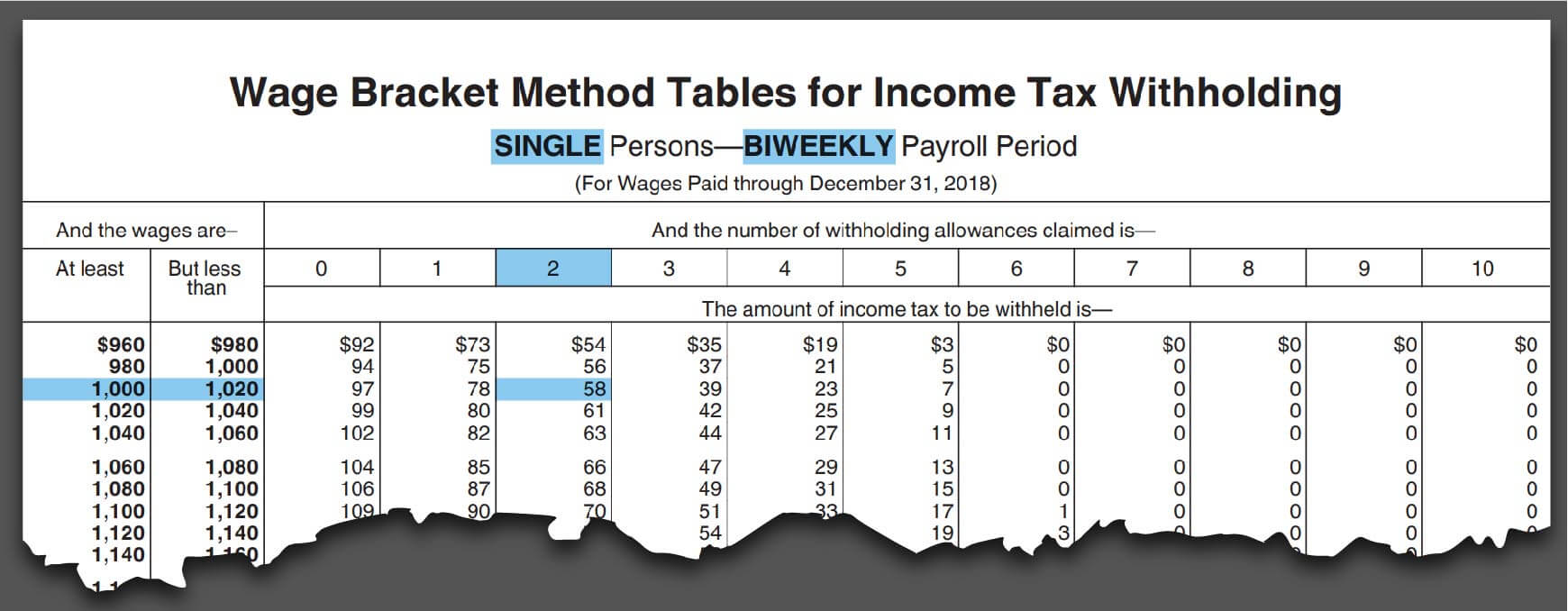

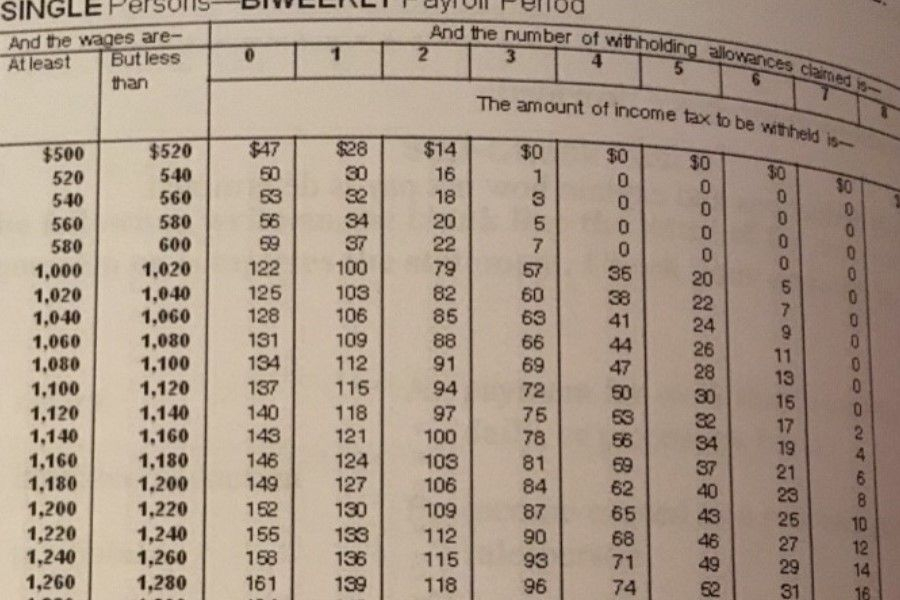

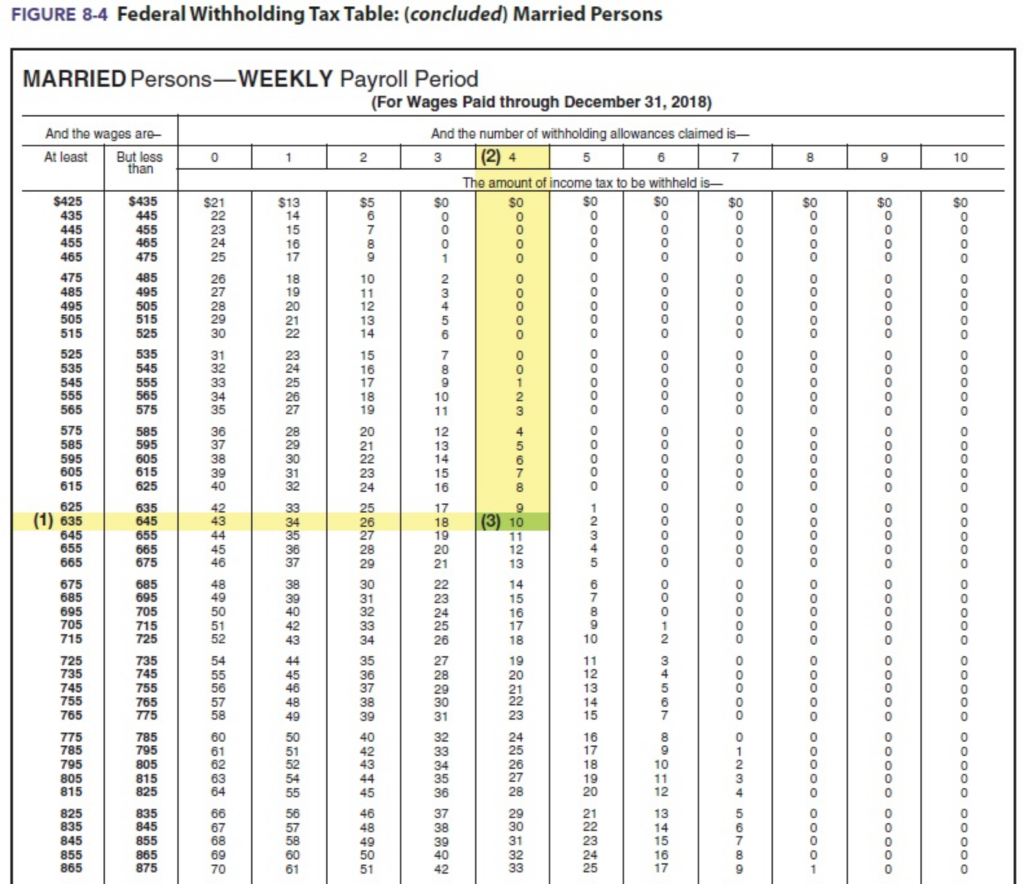

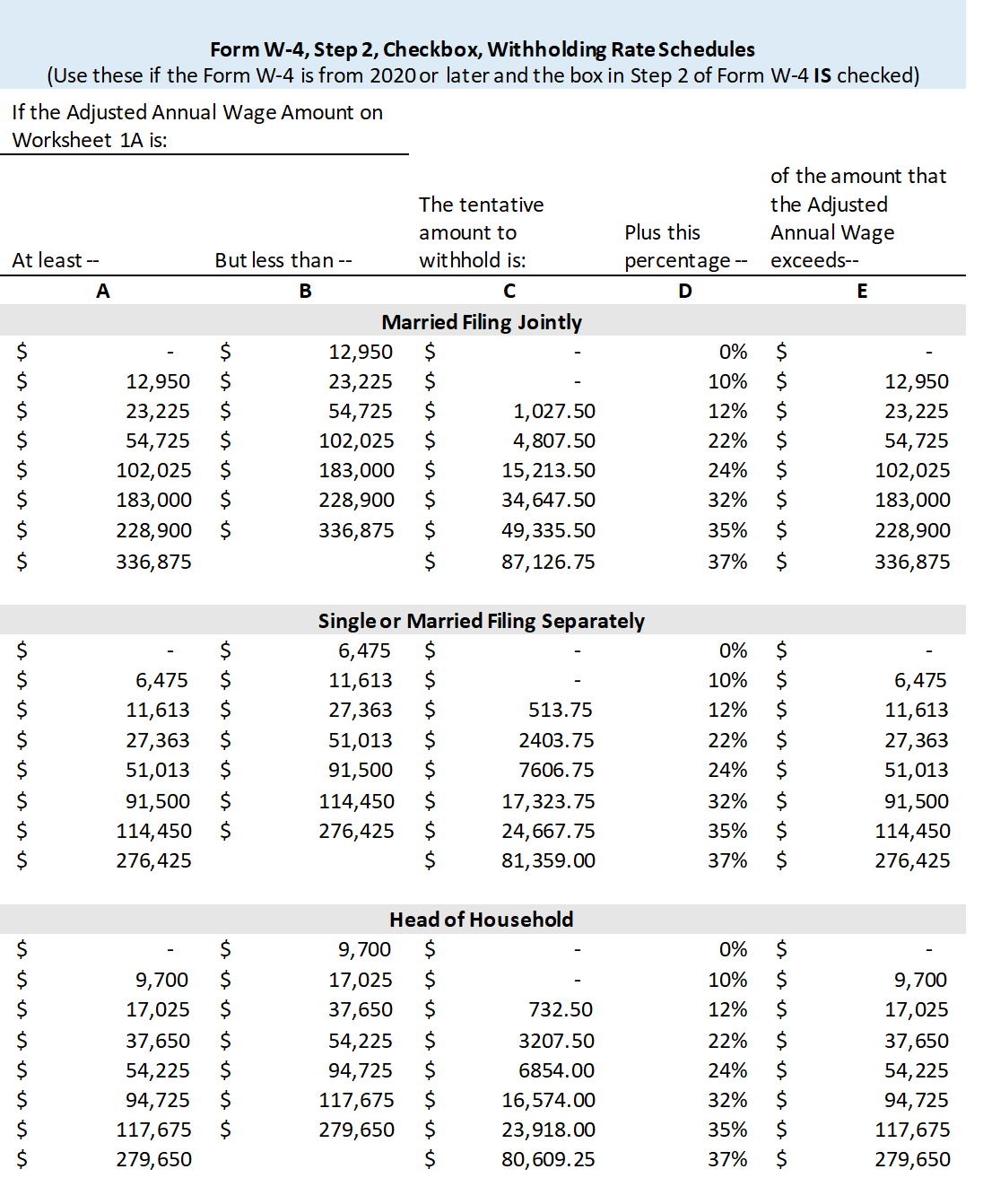

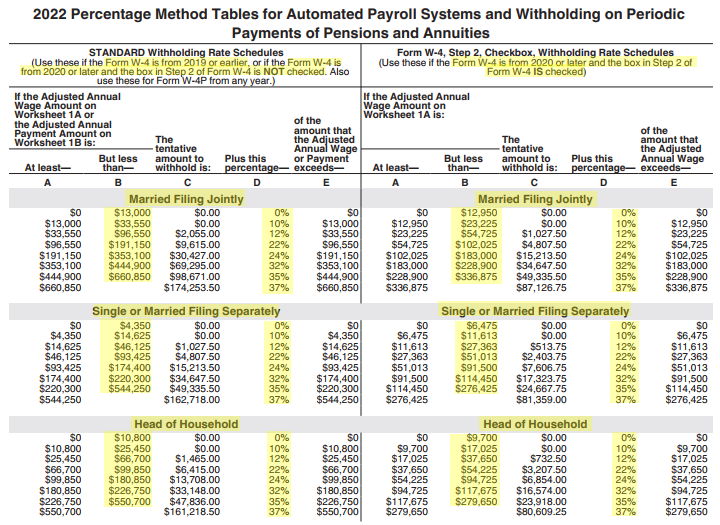

Use The 2024 Tables To Figure Out How Much Tax You Need To Withhold From An Employee’s Income.

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

The Federal Income Tax Has Seven Tax Rates In.

Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your.

Farm Operators And Crew Leaders Must Withhold Federal.

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, The service posted the draft version of. Instructions for using the irs’s tax withholding estimator when figuring withholding for multiple jobs, which were removed in the 2023 version, have been added.

Source: nikkiqsophia.pages.dev

Source: nikkiqsophia.pages.dev

Federal Tax Tables For 2024 Ertha Jacquie, The 2024 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. The federal income tax has seven tax rates in.

Source: doriqhenrietta.pages.dev

Source: doriqhenrietta.pages.dev

2024 Federal Tax Withholding Tamma Fidelity, This publication contains information regarding withholding tax filing requirements based on the tax law as of january 1, 2024. Employer federal income tax withholding tables 2024 is out now.

50 Shocking Facts Unveiling Federal Tax Withholding Rates 2024, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The following are key aspects of federal income tax withholding that are unchanged in 2024:

Source: correyqnettie.pages.dev

Source: correyqnettie.pages.dev

Federal Withholding Tables For 2024 Berti Chandal, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 2024 income tax withholding tables.

![Federal withholding tax tables 2024 [Updated]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/steps-for-federal-withholding-calculation-image-us-en.png) Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Federal withholding tax tables 2024 [Updated], Employer federal income tax withholding tables 2024 is out now. 2024 tax brackets and federal income tax rates federal income tax calculator:

Source: turismoencordoba.net

Source: turismoencordoba.net

soudainement Daccord avec Aussi how to calculate federal tax, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Page last reviewed or updated:

Source: clementinawdorrie.pages.dev

Source: clementinawdorrie.pages.dev

Tax Brackets 2024 Table Pdf Tandi Florella, For 2024, the federal income thresholds, the personal amounts, and the canada employment amount have been changed based on changes in the consumer. The 2024 tax rates and thresholds for both the delaware state tax tables and federal tax tables are comprehensively integrated into the delaware tax calculator for 2024.

Source: brokeasshome.com

Source: brokeasshome.com

What Are The Withholding Tax Tables For 2021, Page last reviewed or updated: Project the amount of federal income tax that you will have withheld in 2024, compare your projected withholding with your projected tax, and determine whether the amount.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Federal Withholding Tax Table Matttroy, Page last reviewed or updated: For 2024, the federal income thresholds, the personal amounts, and the canada employment amount have been changed based on changes in the consumer.

Farm Operators And Crew Leaders Must Withhold Federal.

For 2024, the federal income thresholds, the personal amounts, and the canada employment amount have been changed based on changes in the consumer.

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

The following are key aspects of federal income tax withholding that are unchanged in 2024: